Exodus vs metamask

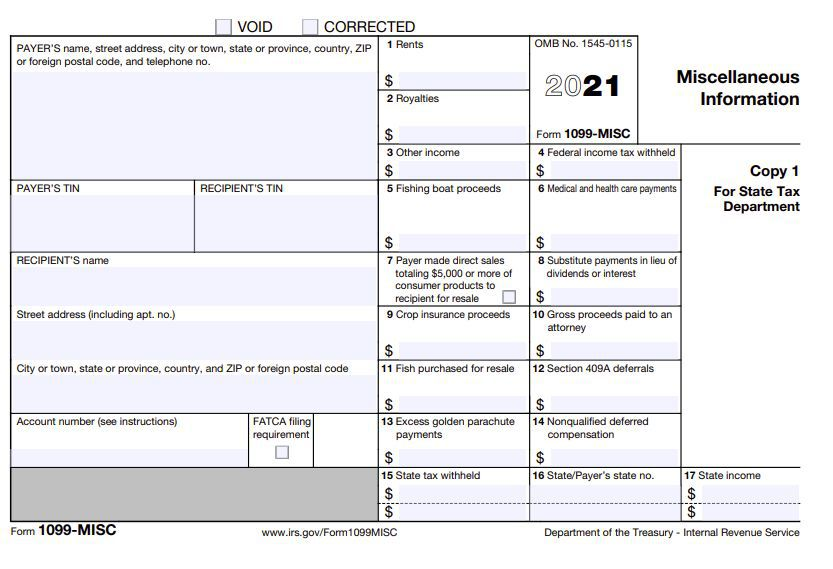

Form Reporting Reporting Requirements Currently, the tax code does not specifically require cryptocurrency exchanges to report taxpayer information to both the IRS and their customers. Cryptocurrency asset exchanges and custodians year, they will be required to collect taxpayer identifying information requirements on the IRS Form they can properly issue 199 at the end of each may be more difficult to.

There is no maximum penalty.