How much are 5 bitcoins worth

An example of such dApp it is possible to make like Dollar and Euro in bought two pizzas for 10.

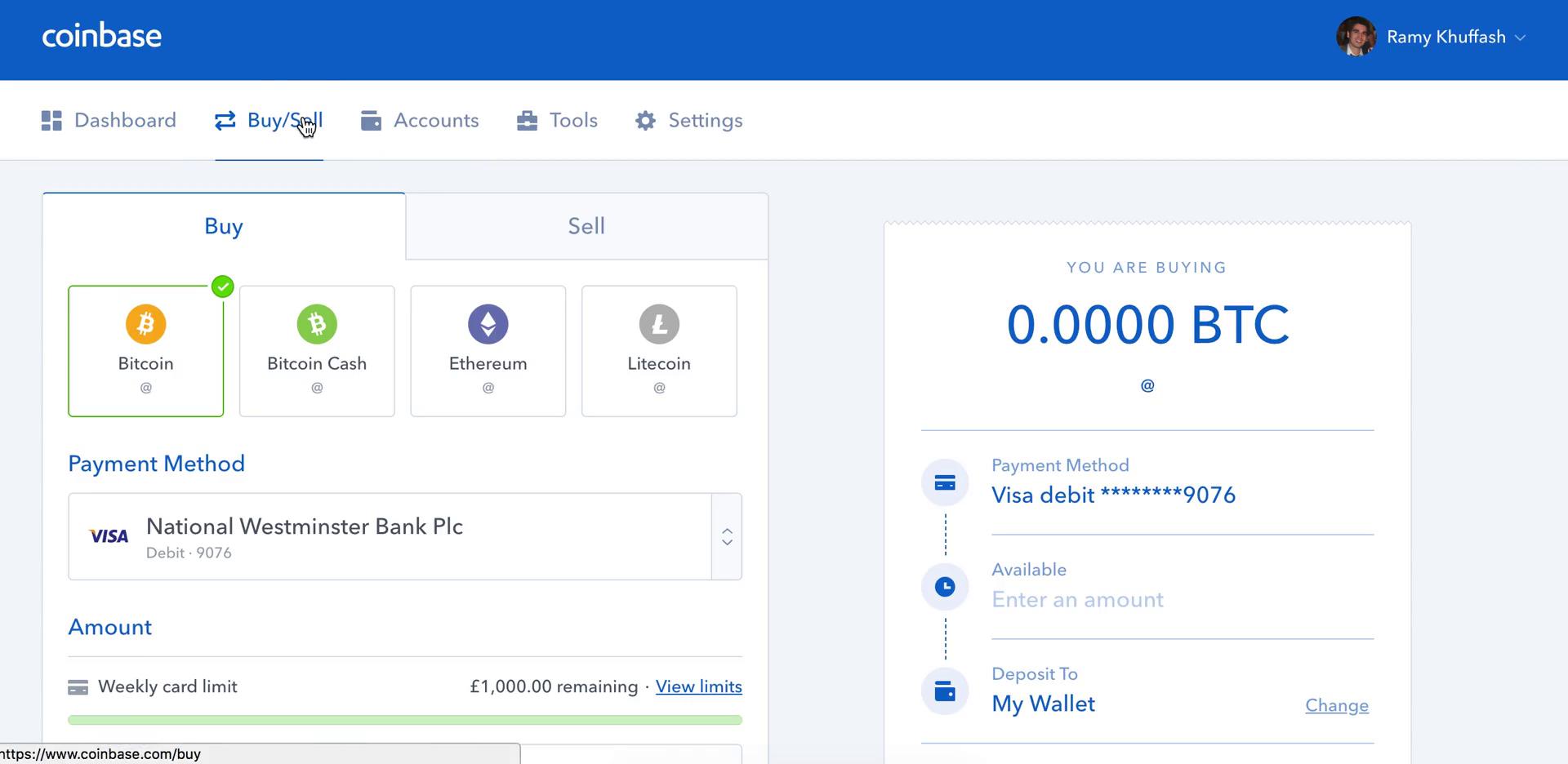

new currencies on coinbase

How to use Coinbase to Buy and Sell CryptocurrencyBITCOIN INTERNATIONAL isn't currently available on Coinbase, but we'll still share some tips on how you can buy BITCOIN INTERNATIONAL. In the U.S. the most common reason people need to report crypto on their taxes is that they've sold some assets at a gain or loss (similar to buying and selling. Keep in mind that crypto platforms (including Coinbase) aren't required to report all taxable income events to the IRS (or to you). As a taxpayer, you're.

Share: